The Impact Principles (Operating Principles for Impact Management) are international standards for impact investment. As of May 2024, 183 organisations across 40 countries have signed up (including 8 from Japan, with 5 having completed verification). However, its adoption in Japan is still in its early stages.

SIIFIC signed up as an organisation in June 2023 when establishing the “SIIFIC Wellness Fund.” Additionally, SIIF (Japan Social Innovation and Investment Foundation) signed the Impact Principles in December 2022 alongside Shinsei Impact Investment. Their “Hataraku FUND” adheres to these principles. Here, Reiri Miura, Co-Founder and Representative Partner of SIIFIC speaks with Nanako Kudo, Executive Director and Yuya Kato, Impact Officer of SIIF about what is required to sign the Impact Principles and the benefits of doing so.

What are the Impact Principles?

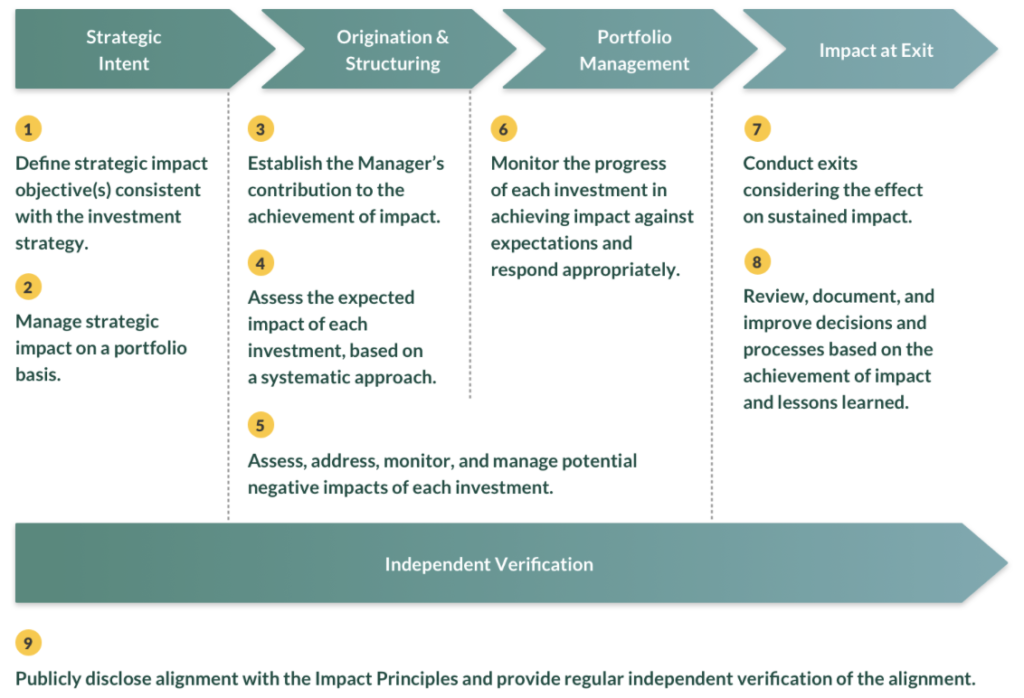

The Impact Principles provide a framework for investors to design and implement an impact management system, integrating impact considerations throughout the investment lifecycle. There are nine principles divided into five stages: “Strategic Intent,” “Origination & Structuring,” “Portfolio Management,” “Impact at Exit,” and “Independent Verification.”

Source: Operating Principles for Impact Management: The 9 Principles

The Impact Principles were published in 2019 by the International Finance Corporation (IFC), part of the World Bank Group focused on developing the private sector in emerging markets. Currently, the Global Impact Investing Network (GIIN) serves as the secretariat. While there are several similar international standards, the Impact Principles are unique in being the most trusted and globally recognised framework specifically for impact investment.

Why Sign the Impact Principles?

Nanako

NanakoWhat motivated each of you to sign the Impact Principles?

Reiri Miura: For SIIFIC, the motivation was straightforward. As we aim to be a global impact fund, it was natural to operate from the outset according to global standards. Since the Impact Principles are the most recognised framework worldwide for impact investing, signing them was our first step.

Yuya Kato: For SIIF, signing was essential to achieve the objectives of the “Hataraku FUND.” Our mission is to prove that a full-scale impact investment fund involving institutional investors can succeed in Japan. There are two key points to this success: first, ensuring portfolio companies achieve impact-oriented IPOs, and second, operating the fund in line with global impact investment standards. To validate and publicise these points, it was crucial to involve external perspectives and undergo verification by signing the Impact Principles. This public declaration asserts that “this fund is properly managing impact.”

What are the Conditions for Signing the Impact Principles?

SIIFIC started moving towards signing even before the fund was established, right?

Reiri Miura: Yes, about a month before the fund’s launch, we inquired with the secretariat if we could sign simultaneously with the fund’s launch. The response was that as long as our impact management system is in place, we could sign at any time. It wasn’t necessary to have practical experience; having a documented impact management system was sufficient. According to the secretariat, many organisations sign during their fundraising process.

Yuya Kato: The signing entity can be an organisation, a fund, or even at the investment level.

So, anyone willing to engage in impact management can sign?

Yuya Kato: Basically, yes. Additionally, it’s required to pay a registration fee based on the amount of assets under management and to submit a Disclosure Statement within a year of signing. Disclosure Statement explains how the organisation’s impact management system aligns with the nine principles.

Reiri Miura: To become a signatory, you must establish an impact management system consistent with the Impact Principles. After signing, within two years, an independent verification must be conducted to ensure the fund is operating according to the Disclosure Statement. Subsequent verifications are required every one to five years.

What are the Benefits of Signing the Impact Principles?

What are your thoughts after signing the Impact Principles? How do you perceive them?

Yuya Kato: I see the Impact Principles as a comprehensive and user-friendly guide for anyone committed to impact investing. They cover the entire range of necessary activities—developing an investment strategy, building a portfolio, selecting investments, engaging as an investor, measuring impact, managing risks, and making the whole process transparent and continuously improving.

Even before signing, we prided ourselves on properly managing and measuring impact. However, without signing and undergoing independent verification, others might dismiss our efforts as mere self-assessment. Signing and being verified provide a seal of approval and ensure objective credibility.

Reiri Miura: Becoming a Signatory has given us a ticket to enter the impact investment community. When we participate in the global impact investment community, mentioning we’ve signed the Impact Principles immediately identifies us as an impact fund, putting us on an equal footing with others.

So, it’s about being recognised as an impact investor adhering to global standards, with international organisations validating your impact management. This could be crucial to avoid impact washing.

In Part 2, we will deep dive into the real of “Disclosure Statement” and the “Independent Verification”.