Impact Investing

Formal Definition

“Investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”

— Global Impact Investing Network (GIIN)

(Source:GIIN, Core Characteristics of Impact Investing)

At SIIFIC, we extend this formal definition by centering our work on people and the systems that shape their lives—positioning capital as a tool for redesigning those systems to advance wellness equity. Here we present SIIFIC’s perspective on impact investing and outline our distinctive approach to deploying capital to drive systemic change.

# Impact-First and Finance-First

In the field of impact investing, investment approaches are often distinguished along two axes: “impact-first” and “finance-first.”

Impact-first funds and organizations prioritize mission alignment and social purpose, and they do not necessarily seek full capital recovery or market-rate returns. These investors aim to generate impact across all aspects of their activities, increasingly adopting frameworks such as the Operating Principles for Impact Management (OPIM) and the Theory of Change (ToC) as they move toward more disciplined and transparent impact management.

In contrast, finance-first impact venture capital funds seek to deliver clear financial returns while simultaneously generating social and/or environmental impact. These funds tend to standardize both their financial evaluation processes and their Impact Measurement & Management (IMM) practices to maintain efficiency and operate in line with the performance expectations of conventional investment funds.

SIIFIC places equal weight on both objectives. Our investment system is designed to achieve market-rate returns as a venture capital fund while intentionally pursuing system change through impact investing. Our ambition is to ensure that “impact” is not merely an aspirational concept or a statement of vision, but a measurable and operationally meaningful outcome grounded in evidence.

#Measure & Manage Impact

Formal Definition

“Impact Measurement & Management (IMM) is the process of identifying and measuring the positive and negative impacts of investments and using this information to improve decision-making.”

— Global Impact Investing Network (GIIN)

(Source:GIIN, Impact Measurement and Management)

In the Seed Rocket Fund established in 2016 by SIIFIC’s Founding Partner Umeda together with M3, one of the portfolio companies, a medical device startup developing Class IV implantable devices co-founded with a seasoned regulatory consultant, had successfully secured patents, completed multiple pre-clinical studies, obtained regulatory approvals, and brought several commercially viable products to market. Yet, despite this progress, the company was unable to execute its planned M&A strategy.

Partnership negotiations with large corporations also proved difficult. With limited runway and only modest first-year sales from direct distribution, the startup often found itself negotiating from a structurally disadvantaged position. The breakthrough came through Impact assessment. By assessing impact, the startup was able to articulate its value and future potential using forward-looking, non-financial metrics, quantifying its contribution beyond revenue and profit in a way that resonated with strategic partners and investors.

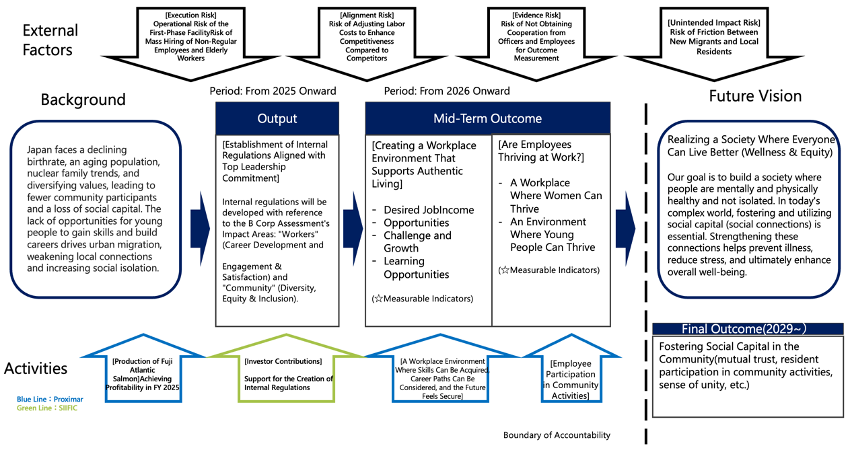

In practice, IMM is embedded within our broader Impact Management System and is grounded in systems thinking. Through this process, SIIFIC identifies impact pathways, translates short-, medium-, and long-term outcomes into measurable and operationally meaningful KPIs, and monitors them continuously. We believe this approach allows us to overturn the conventional assumption that “impact cannot be discussed until all impact KPIs are fully established.”

#Systems Lens

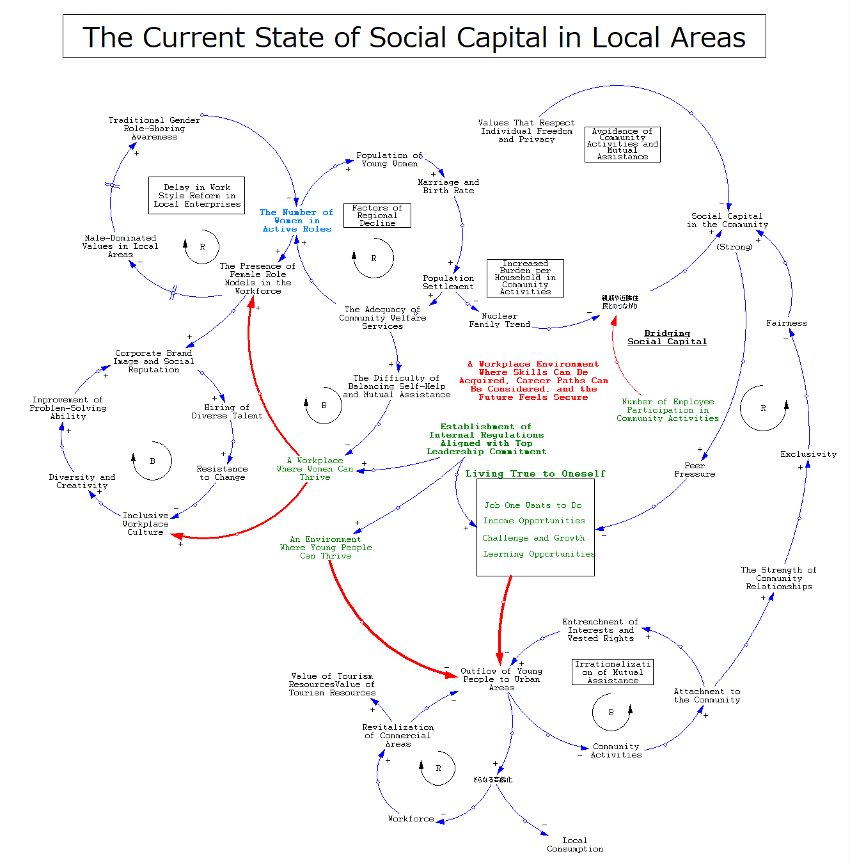

A defining feature of SIIFIC’s approach to impact investing is our use of a systems lens grounded in systems thinking. “Systems thinking” is a discipline that views phenomena not as isolated parts but as interconnected wholes. By looking beyond discrete events and instead examining the patterns, structures, and underlying mental models that generate them, systems thinking enables deeper insight and more durable change.

Across the field, practitioners are increasingly incorporating systems thinking into investment decision-making, evidence of a broader shift in impact investing from a focus on “measurement and management” toward an ambition of “systems change.” This shift is also allowing investors to move beyond the limitations of conventional linear logic models and to adopt a more expansive, structural understanding of how change occurs.

In SIIFIC’s investment practice, we deliberately avoid relying solely on linear frameworks such as logic models. Instead, we extend our analysis to include feedback loops, institutional constraints, and the dynamic interactions between people and their environments. By introducing systems thinking, our impact investing and IMM processes evolve beyond business KPIs and numerical evaluation, enabling us to understand social and business transformation as a chain of causal relationships within a larger system.

#A Theory of Change (ToC) That Moves People

A systems-change narrative derived from systems thinking is expressed as a Theory of Change (ToC). A ToC visualizes how and why expected changes occur, articulating the gap between the desired future state and the present reality. It is a tool for planning how an organization or initiative generates change, assessing effectiveness, and communicating the process of change to stakeholders. In this sense, a ToC functions as a “compass” that is continuously refined as activities evolve.

At SIIFIC, we develop ToCs by applying systems thinking to identify the causal relationships that constitute a system, along with the patterns, structures, and underlying mental models that create them. Our analysis extends to feedback loops, institutional constraints, and the dynamic interactions between people and their environments. Through this approach, we craft ToCs that genuinely move people, actionable narratives that sit at the core of our Impact Measurement & Management (IMM) practice and distinguish SIIFIC’s investment approach.

#A Blueprint for Collective Learning

Within the IMM process, organizations often produce an Impact Performance Report, a document that assesses how investment activities and portfolio operations have contributed to addressing social challenges and presents the results of that assessment. At SIIFIC, we view the Impact Performance Report not merely as a vehicle for reporting outcomes, but as a “blueprint for collective learning” shared among investors, portfolio companies, and other stakeholders.

This approach shifts the fund–portfolio relationship from one of monitoring to one of co-creation, fostering a dynamic in which system change becomes observable and actionable. Through this practice, SIIFIC distinguishes itself not as a fund that simply measures outcomes, but as one that actively influences systems and catalyzes change for people and society.

Through the SIIFIC Wellness Fund, we aim to drive system change in the wellness domain. For more detail on wellness and the SIIFIC Wellness Fund, please refer to the related keywords.