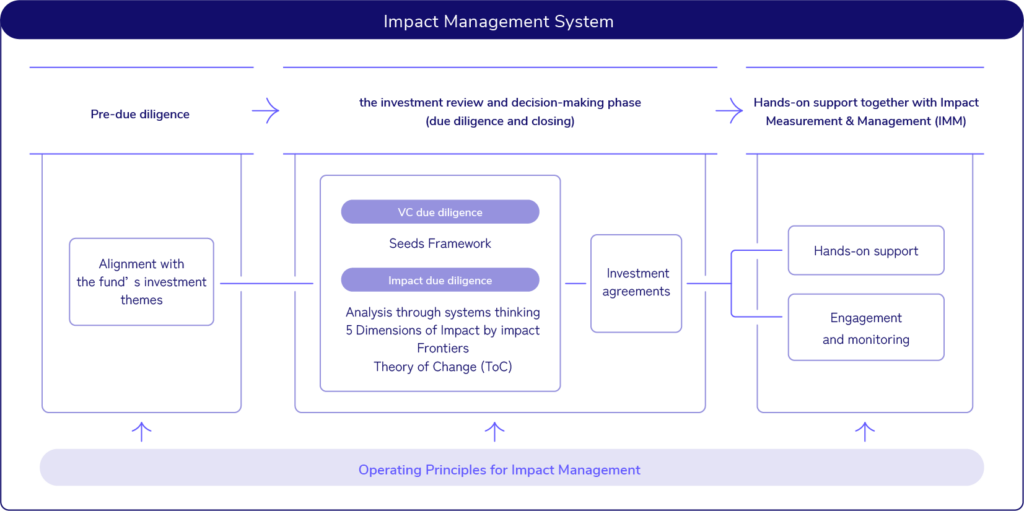

Impact Management System

Here we provide an overview of the full lifecycle of the impact investing process.

SIFIC’s iImpact investing in three stages:

(1) the preliminary phase prior to due diligence (pre–due diligence),

(2) the investment review and decision-making phase (due diligence and closing), and

(3) post-investment hands-on support together with Impact Measurement & Management (IMM).

Taken together, these stages constitute our Impact Management System, which is disclosed in our Disclosure Statement in line with international standards.

Implementation Processes within the Impact Management System

#Pre–Due Diligence

In the pre–due diligence phase, we review pitch materials and other documents submitted by prospective startups to assess their alignment with the fund’s investment themes. Based on this assessment, we determine whether to proceed to deeper due diligence.

#Due Diligence

The due diligence phase consists of two parallel processes:

(1) conventional venture capital due diligence (VC due diligence) on financial and business fundamentals (VC due diligence), and

(2) impact due diligence, which evaluates the potential social and environmental impact, both positive and negative.

VC Due Diligence

In VC due diligence, SIIFIC conducts its assessment using a proprietary framework – “Seeds Framework” – established by the Founding Partner Kazu based on his investment experience. This framework evaluates opportunities from the perspectives of Idea, Science, and Needs.

Impact Due Diligence

SIIFIC conducts impact due diligence using our systems thinking approach. Systems thinking analyzes feedback loops, institutional constraints, and human–environment interactions, enabling a structural understanding of social and business change through chains of causality. Based on stakeholder research and quantitative data, we develop a “systems map” that visualizes the key elements and their interrelationships.

Analysis Using the “5 Dimensions of Impact”

For more granular impact and risk assessment, SIIFIC applies the 5 Dimensions of Impact by Impact Frontiers – a global framework widely used by international investors. This approach enables multidimensional analysis of impact and ensures that SIIFIC evaluates opportunities in line with global standards, regardless of whether the activity takes place in Japan or abroad.

Theory of Change (ToC) Development

Informed by discussions with stakeholders, the systems map is iteratively updated and serves as the basis for developing the Theory of Change (ToC) – the foundation of our IMM practice. SIIFIC’s ToC, adapted into a linear structure for operational clarity, organizes the contextual factors surrounding the company, the anticipated societal and environmental effects of its activities, and the outcome-based indicators (“impact KPIs”) used to evaluate these changes.

The ToC functions as a compass that clarifies how change is generated, enables evaluation of effectiveness, and communicates the change process to stakeholders. It is continuously refined as organizational activities evolve.

#Investment Decision & Deal Closing

Investment decisions at SIIFIC are made by integrating the two parallel due diligence processes – VC due diligence and impact due diligence. Final approval is based on the feasibility of achieving both financial returns and social impact, treated as dual and equally weighted objectives.

#Impact Measurement & Management (IMM)

Within the IMM process, organizations typically prepare an Impact Performance Report to assess and communicate the extent to which investment activities and portfolio operations contribute to solving social challenges. At SIIFIC, we view this report not merely as a mechanism for reporting outcomes, but as a “blueprint for collective learning” shared among investors, portfolio companies, and stakeholders. This represents a shift from using the report as a tool for evaluating portfolio companies to using it as a tool for learning with and growing alongside them.

Underlying this approach is SIIFIC’s deep sense of investment responsibility – our “radical ownership” – which fundamentally distinguishes us from other venture capital firms. SIIFIC conducts IMM for every portfolio company and is committed to contributing to the continuous improvement of impact through ongoing dialogue grounded in international principles and guidelines.

Alignment with the Operating Principles for Impact Management

The design and implementation of SIIFIC’s Impact Management System comply with the Operating Principles for Impact Management (OPIM) – the international standard for impact investing. Our approach is disclosed in our Disclosure Statement, which provides transparency on our alignment with the Principles.