Systems Thinking

Systems thinking is an approach that views phenomena not as isolated parts but as interconnected wholes. Instead of focusing solely on events, it examines the patterns, structures, and underlying mental models that generate those events – enabling deeper insight and more durable change. Applying systems thinking is one of the defining features of SIIFIC’s impact investing approach.

#Case Study: J Pharma

A concrete example is SIIFIC’s use of systems thinking during the due diligence for J Pharma, a company developing oncology therapeutics. In this analysis, we explored the central question: “What are the systemic challenges in cancer treatment?”

Through extensive dialogue with patients and their families, healthcare professionals, pharmaceutical companies, and public-sector actors, we mapped the lived realities of cancer treatment and identified the points where intervention is most needed. We then organized these insights into a structured causal map.

This systems map was developed over several months of discussion, iteration, and revision – reflecting SIIFIC’s commitment to rigor, inclusiveness, and the pursuit of structural understanding in our investment process.

画像

Systems Map Created During J Pharma’s Due Diligence

While impact assessments are increasingly conducted within Japan’s impact investing community, few investors analyze the underlying system of the societal challenge itself. In oncology drug development, regulatory approval has traditionally focused on tumor shrinkage as the primary indicator of efficacy. Yet if the true purpose of cancer treatment is to support the holistic well-being of patients, including their lives, daily functioning, and relationships with family and community, these dimensions must also be measured.

Through the discussions that led to the development of J Pharma’s systems map, we discovered that the company was in fact designing its oncology therapeutics with the patient’s quality of life (QOL) at the center. By viewing the challenges of cancer treatment as a system, the analysis also broadened our focus beyond patients to include healthcare professionals. One example is the short-term impact KPI we established: “physician satisfaction.”

Patients often describe the most devastating moment not as the initial diagnosis, but when their physician tells them that no further therapeutic options remain. For late-stage cancer patients with limited treatment choices, receiving a highly efficacious therapy can restore meaning in their lives and directly improve QOL. This outcome, in turn, contributes to physicians’ sense of purpose and professional fulfillment.

Once a drug is approved, business KPIs typically focus on commercial metrics such as the number of patients treated. In contrast, the impact KPIs – such as “physician satisfaction rate” and “patient recreation/quality-of-leisure improvement” – reflect fundamentally different qualities and often sit in tension with business KPIs. This tension is precisely what characterizes the essence of impact investing.

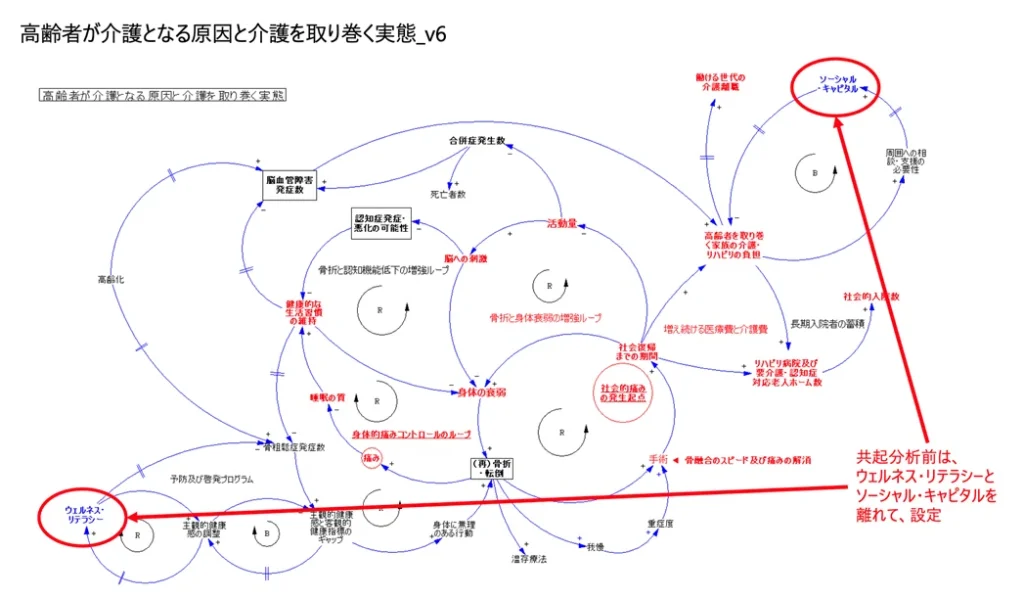

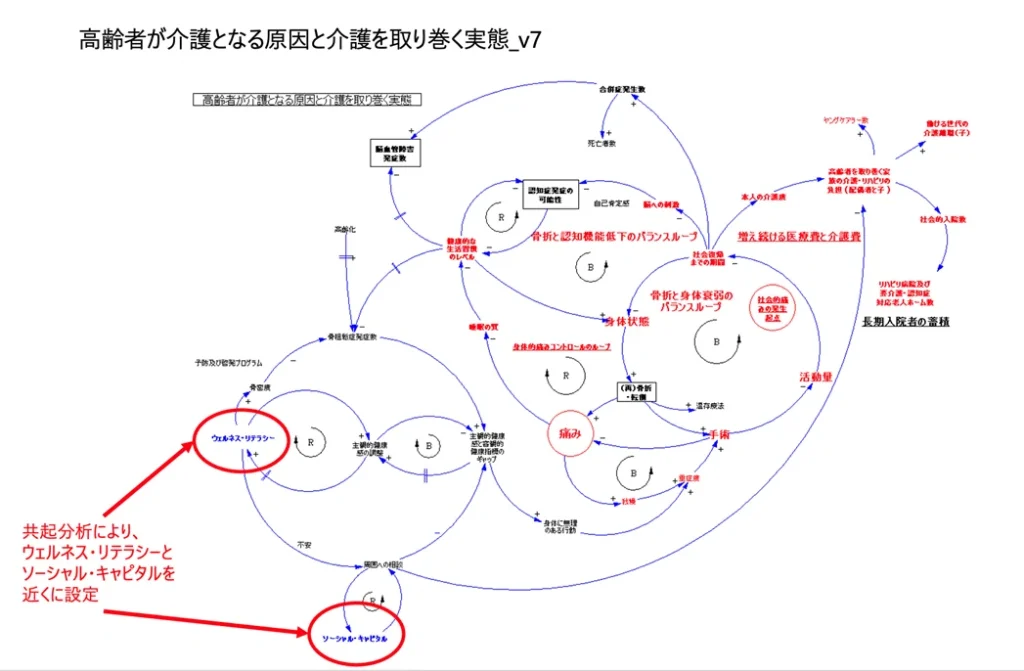

#Case Study: ORTHOREBIRTH

Another example is ORTHOREBIRTH, SIIFIC’s second investment, a startup developing therapeutics that promote bone regeneration. In constructing the systems map for this company, two variables emerged as essential: “wellness literacy” and “social capital.” These variables also serve as the leverage points of the SIIFIC Wellness Fund.

In the early stages of the analysis, the two variables were positioned at opposite ends of the systems map. However, as the analysis progressed, it became clear that wellness literacy and social capital were, in fact, closely interconnected. This insight led us to reposition the variables closer together, an adjustment that significantly improved the coherence of the systems map and sharpened our understanding of the pathways to system change.

What emerged from the revised systems map was the insight that improving fracture treatment for older adults – and preventing them from becoming bedridden – could directly contribute to mitigating Japan’s broader caregiving challenges. When we shared this finding with ORTHOREBIRTH’s leadership team, their response was striking. Their expressions changed, and they began speaking with renewed energy about the deeper mission of their product.

From this dialogue, a new concept surfaced: “social pain.” When older adults enter a state requiring long-term care, the consequences ripple outward, often leading to issues such as caregiver resignation and the rise of young caregivers. ORTHOREBIRTH’s leadership named this burden “social pain” and reframed their mission as not only relieving physical pain, but also liberating people from social pain. This principle was incorporated into the final systems map.

This example illustrates how systems thinking enables us to reconsider even the fundamental question of a startup’s purpose within a larger system: For whom does this company exist, and why? Through this process, partner companies gain fresh insights – and for many founders, it becomes a moment that reignites the passion that originally drove them to create their venture.

#The Fallacy of Conventional Logic Models

The logic model – commonly used in traditional impact due diligence – is a strong framework for organizing linear causal relationships such as “inputs → activities → outputs → outcomes → impact.” However, logic models tend to overlook feedback loops, institutional constraints, human–environment interactions, and unintended side effects. As a result, they can reinforce the simplistic assumption that “more activities will automatically produce more impact.”

When SIIFIC began its research in 2022, many prospective portfolio companies articulated abstract and generic outcomes such as optimizing healthcare costs or extending healthy life expectancy. Such indicators often obscure the specific impact created by each company, and in some cases, business plan financials were mistakenly presented as impact outcomes.

Systems thinking introduces an important lens that is often missing from conventional logic models: “negative impact.” Feedback loops used in systems mapping make it easier to surface potential harms or counterproductive effects – elements that logic models largely fail to capture.

Impact due diligence is therefore not a replacement for traditional VC due diligence but a complement to it. Through systems thinking, the process reveals what is not written in a company’s business plan and enables a deeper examination of the fundamental nature of the enterprise.

#Benefits of Integrating Systems Thinking into Impact Investing

The advantages of incorporating systems thinking into the investment process include the following:

1. Potential to Generate More Sustainable and Enduring Impact

By addressing structural factors – such as policies, regulations, and infrastructure – systems thinking helps reveal and remove barriers that single-point interventions typically overlook. This prevents the erosion of outcomes over time and enables more stable, long-lasting impact across the portfolio.

2. Expanding the Investor’s Role from “Capital Provider” to “System Shaper”

Systems thinking allows investors to move beyond providing capital and engage in the design of the system itself – shaping contractual terms, setting expectations for disclosure, and influencing how relationships with communities and stakeholders are built. Investors thus become active architects of the conditions in which portfolio companies operate.

3. Strengthening Risk Management

Visualizing the entire system makes it possible to identify often-overlooked risks – delays, institutional resistance, unintended side effects, and other dynamics that can undermine performance. When contracts and impact KPIs are structured with these risks in full view, investors can significantly reduce decision-making errors.

4. Enabling Learning- and Adaptation-Oriented Fund Operations

Systems thinking encourages continuous learning and adaptation. As circumstances change, investors and portfolio companies can update their models, redesign structures, and refine interventions. Those who operate with this adaptive mindset are the ones capable of maintaining influence and relevance over time.