Impact Measurement & Management (IMM)

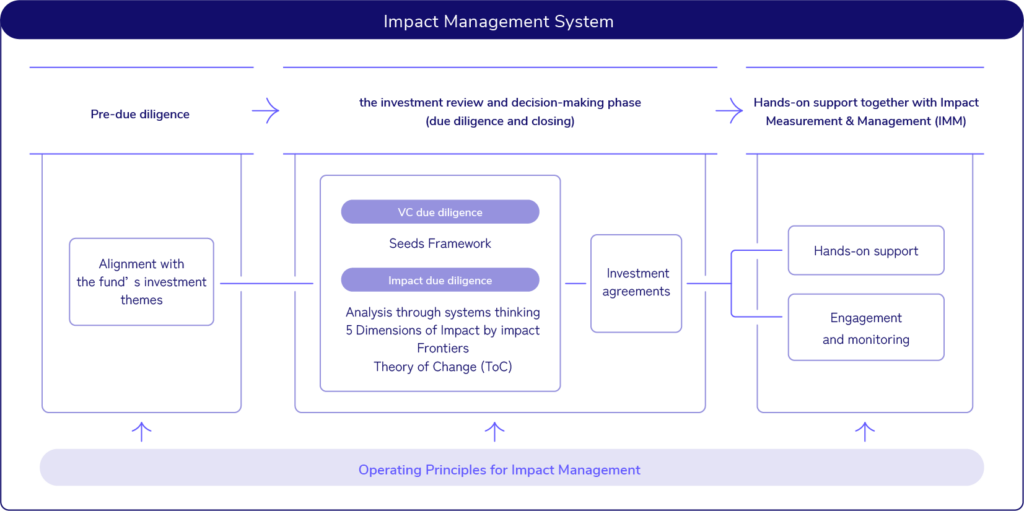

Following an investment, impact investing transitions into the phase of Impact Measurement & Management (IMM). Here we outline SIIFIC’s approach to IMM.

IMM is the phase in which the impact KPIs defined during impact due diligence are monitored and used to support the growth of each portfolio company. SIIFIC conducts IMM for every investee and is committed to enhancing their impact through ongoing dialogue grounded in internationally recognized principles and guidelines. This approach represents a fundamental departure from conventional venture capital practice.

#Radical Ownership: Always Thinking From the Other’s Perspective

At the heart of SIIFIC’s approach is “radical ownership” – a commitment to fully understanding the perspective of the portfolio companies and engaging with every emerging challenge as if it were our own. Rather than simply providing capital or monitoring KPIs, SIIFIC actively steps in, working alongside portfolio companies to help realize their intended impact.

We distinguish between two forms of post-investment involvement: hands-on support and engagement. Clarifying this distinction reinforces that the fund is not merely a provider of capital but a co-creator of impact.

#Hands-On Support

“Hands-on support” refers to direct involvement in operational and strategic matters, including management and capital planning. To enhance corporate value and maximize investment returns, SIIFIC provides support such as:

- Developing management strategies, R&D strategies, and business plans

- Supporting fundraising (grants, equity, debt, and partnerships with overseas institutional investors)

- Coordinating with external experts

- Supporting business development and overseas expansion

#Engagement

“Engagement” refers to supporting portfolio companies in cultivating and managing their impact through dialogue and relationship-building. In alignment with internationally recognized principles and guidelines, SIIFIC conducts the following:

- Clarifies the fund manager’s contribution to impact realization (investor contribution)

- Measures and manages impact KPIs and prepares impact reports

- Identifies, mitigates, and manages potential negative impacts

- Executes exits that take into account the sustainability and continuity of impact

#Collective Learning

A central concept within the IMM process is “Collective Learning.” Impact venture capitals and impact startups typically prepare an Impact Performance Report to assess how their activities contribute to solving social challenges. At SIIFIC, this report is not merely a summary of results – it is treated as a “blueprint for collective learning” shared by investors, portfolio companies, and stakeholders.

For SIIFIC, the report reflects not only outcomes but the entire process undertaken together with the investee:

- co-creating the systems map before investment,

- identifying leverage points,

- establishing impact KPIs, and

- examining baseline conditions

Publishing this process invites external feedback, and incorporating that feedback enables deeper learning among investors, investees, and stakeholders. This iterative, team-based approach is what SIIFIC defines as Collective Learning.

Through this approach, the Impact Performance Report transforms from a compliance-oriented document into a tool that invites new forms of collaboration—shifting the relationship between the fund and the portfolio companies from “monitoring” to “co-creation,” and driving system change in the investment ecosystem.