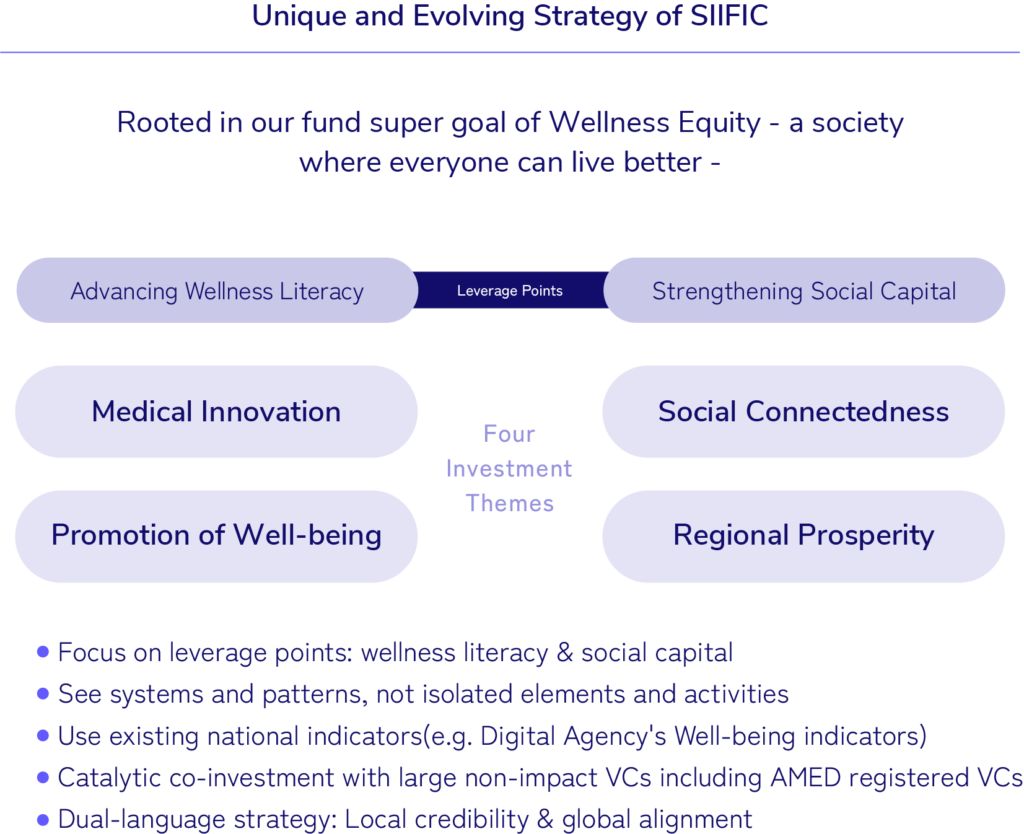

Four Investment Themes

Here we outline the four investment themes established by the SIIFIC Wellness Fund to ensure that all investment activities remain aligned with the fund’s super goal.

The SIIFIC Wellness Fund defines its super goal as the achievement of wellness equity. To prevent the investment strategy from diverging from this objective, four investment themes were set at the time of the fund’s formation:

1. Revolutionizing Healthcare by pioneering trustworthy medical standards. We invest in products and services that redefine healthcare’s reliability and trustworthiness, fostering behavioral change among providers.

2. Empowering Holistic Well-Being by inspiring positive lifestyle and activity choices. We invest in products and services that motivate individuals towards health-positive decisions, emphasizing the critical role of consumer behavior in wellness.

3. Connecting Lives by focusing on fostering loosely connected yet meaningful interactions among individuals. We invest in products and services that value individual autonomy, fostering environments where personal and collective well-being flourish.

4. Cultivating Local Prosperity by promoting economic growth and community vibrancy. We invest in startups that create quality employment opportunities and enhance local life quality.

These four themes were derived by revisiting society through the lens of the fund’s two leverage points—advancing wellness literacy and enriching social capital—and by asking what kinds of change are needed to reach the super goal.

Relationship between the super goal, leverage points, and the four investment themes

#The Road to Our Four Investment Themes

By tracing social changes across the Showa era (1926–1989), the Heisei era (1989–2019), and the Reiwa era (2019–present), a particular perspective emerged. In the Showa era, tightly knit organizations and strong bonding ties helped support society. However, in today’s more diverse era, those same structures can lead to exclusion and deepen inequality. We realized that forms of social capital that once functioned well in Showa Japan have, over time through Heisei and into Reiwa, begun to produce frictions and unintended negative effects. From this realization came a key hypothesis: doing the opposite of what used to work may be what creates change in the next era. Guided by this perspective, we held repeated discussions, narrowed down the options, and ultimately arrived at the four investment themes. The process was not about searching for a single “correct” answer. Rather, it was about understanding where, in the context of our times, the system has become stuck—and how we might intentionally steer in a different direction.

The SIIFIC Wellness Fund bases its investment decisions on maintaining alignment with these four themes, which emerged from that process of reflection and reorientation.

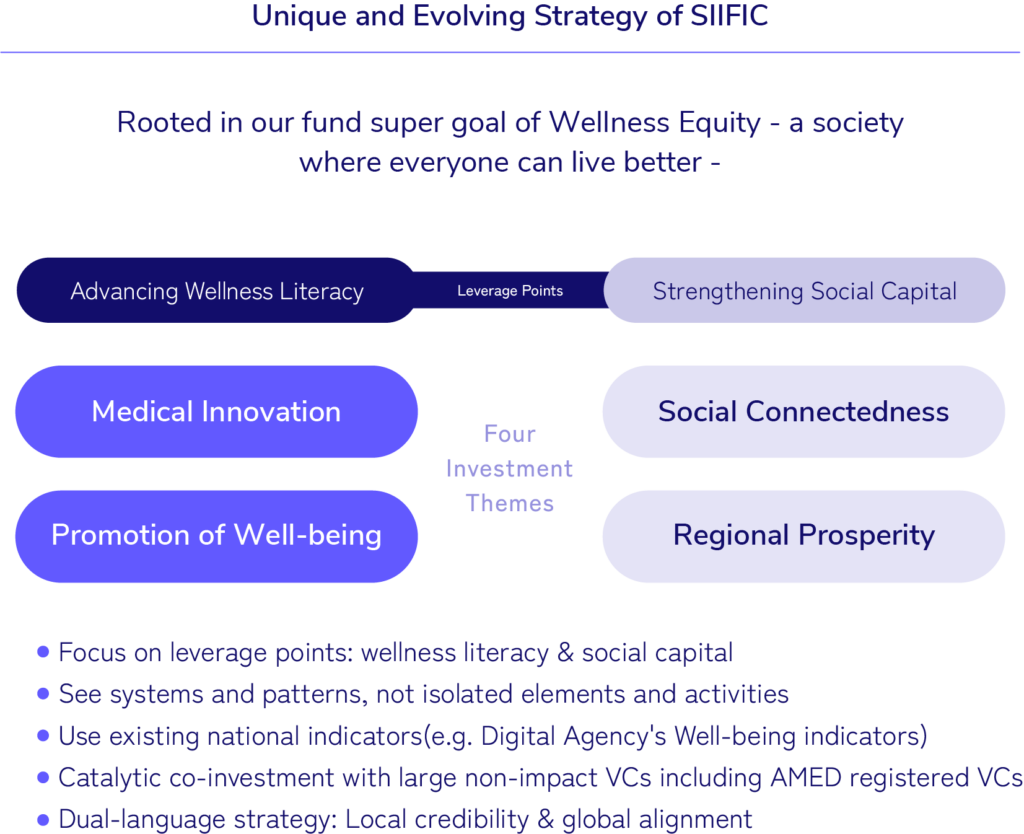

#Investment Themes Related to Advancing Wellness Literacy

Relationship between the super goal, leverage points, and the four investment themes

In Japan, where population aging is among the most advanced in the world, the very notion of “wellness = health” needs to be redefined at a societal level. We must shift from a society that focuses primarily on physical longevity to one that embraces a more holistic state of health—one in which people can proactively and autonomously engage in activities, make choices, and design lifestyles that help them live better.

In other words, we need to move from prioritizing the quantity of life (lifespan) to valuing the quality of living.

We believe that this shift—from a medical paradigm to a wellness paradigm—is essential for achieving wellness equity. Yet to realize such a transformation, we must address numerous, deeply intertwined challenges: identifying current issues, deriving solutions, and making their effects visible. These three steps are precisely what make implementation difficult.

To help drive the shift toward a wellness paradigm, SIIFIC invests in startups that make these complex issues visible and enhance wellness literacy by developing and delivering products and services that enable people to better understand, evaluate, and act on information related to their physical and mental health.

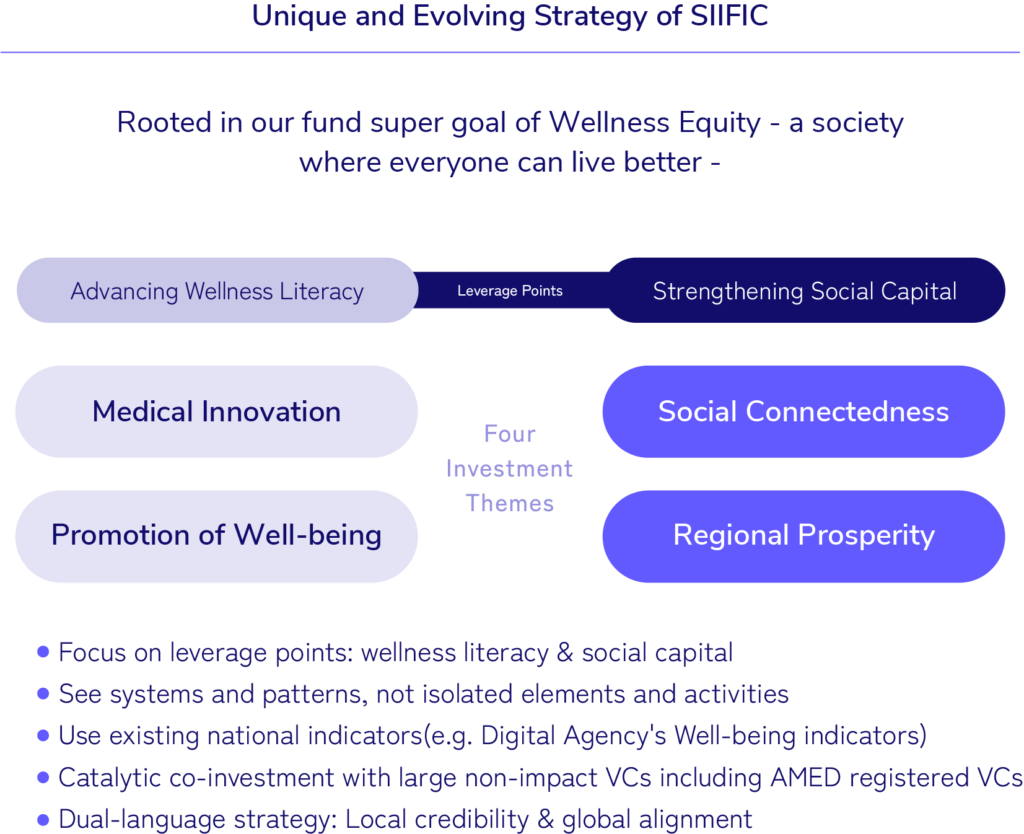

#Investment Themes Related to Enriching Social Capital

Relationship between the super goal, leverage points, and the four investment themes

To build a society in which people enjoy not only physical health but also the ability to engage proactively and autonomously in activities, choices, and lifestyles, it is essential that individuals—on their own wellness journeys—can loosely connect with people holding diverse values, receive social support when needed, and cultivate emotional richness.

Such conditions also contribute positively to the overall health of society.

This perspective is reflected not only in healthcare and pharmaceuticals but across a wide range of potential investees involved in wellness more broadly.

Within this context, Investment Theme 3—products and services that foster loose yet meaningful connections among independent individuals—embodies our “Connecting Lives” perspective by cultivating bridging social capital. We invest in offerings that value individual autonomy while nurturing environments where both personal and collective well-being can flourish.

Drawing on SIIF’s Healthcare Vision Paper, social capital is explained as follows:

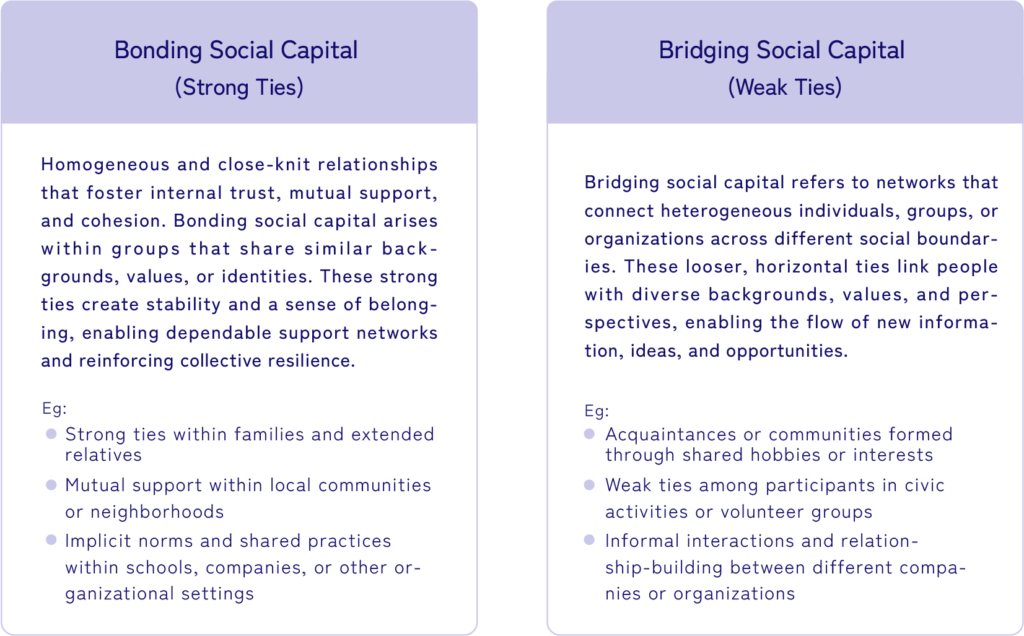

- Bonding social capital refers to strong ties within homogeneous groups. When overly strong, it can create exclusion and barriers to participation.

- Bridging social capital, by contrast, connects people with different backgrounds through light, cross-cutting, “loose ties” that function as a lubricant for trust, information-sharing, and collaboration.

These loose ties align with the vision articulated in the Healthcare Vision Paper: a society where everyone can participate naturally, and where wellness can be sustained over time. For this reason, SIIFIC has identified loose ties as one of the key concepts informing its investment decisions.

Investment Theme 4: Cultivating Local Prosperity. This theme focuses on startups that generate quality employment and enable vibrant, fulfilling lives in regional areas—a distinctive emphasis of the SIIFIC Wellness Fund.

Aligned with our commitment to cultivating local prosperity, we invest in companies that not only create meaningful, skill-building job opportunities but also enhance overall quality of life within local communities.

Such startups may help shift Japan from a Tokyo-centric structure toward a more regionally balanced society. Importantly, our focus is on the quality of employment—meaningful work, fair compensation, opportunities for growth, and supportive environments—rather than the sheer number of jobs.

We prioritize startups that strengthen cross-sector collaboration among industry, government, and academia, and that advance impact creation through the lenses of loose social ties and inclusive regional development.